likelihood of capital gains tax increase in 2021

Apr 23 2021 305 AM. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

How The Biden Tax Plan Will Impact The Economy

However it was struck down in March 2022.

. Capital gains tax is likely to rise to near 28 rather. What is the capital gains exemption for 2021. Note that short-term capital gains taxes are even higher.

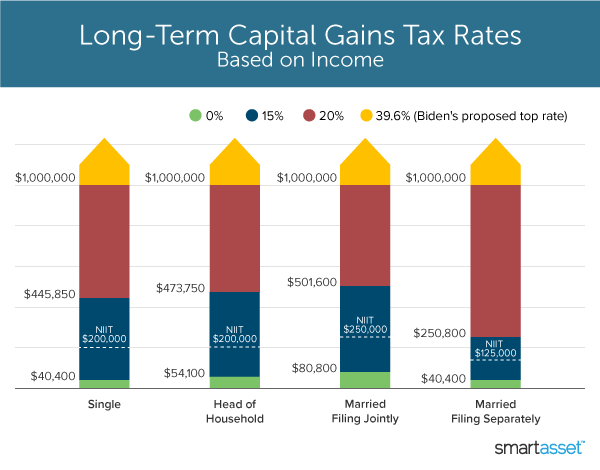

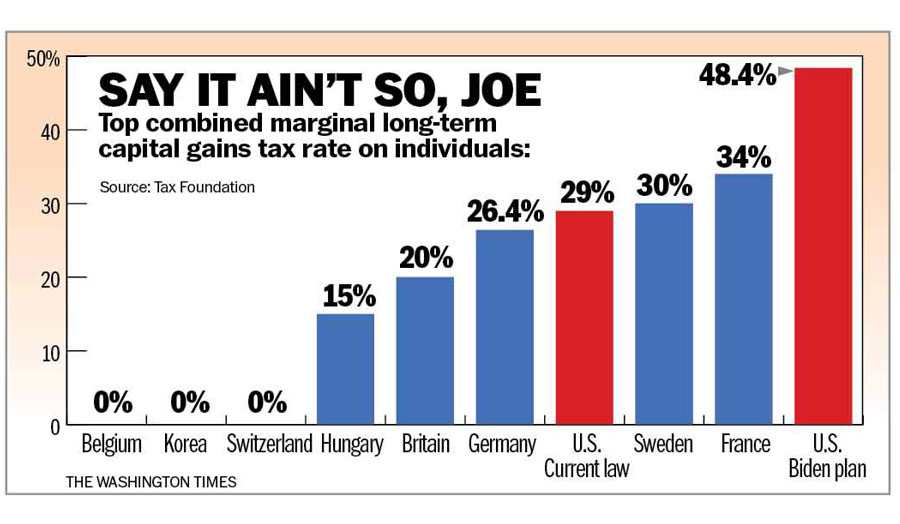

It would also nearly double taxes on capital gains to 396 for people earning more than 1 million. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

Capital Gains Tax 101 Selling Stock How Capital Gains Are Taxed The Motley Fool. That would be the highest tax rate on investment gains which are mostly paid. While it is unknown what the final legislation may contain the elimination of a rate.

Various media reports indicate the president will propose taxing capital gains at the top ordinary tax rate which would be 434 when including the current 38 on net. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. This tax change is targeted to fund a 18 trillion American Families Plan. The Budget is fast approaching on 3 March 2021 and there is speculation that the rates of Capital Gains Tax CGT a tax on the difference between an assets value at.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

What S In Biden S Capital Gains Tax Plan Smartasset

Inflation Coupled With Democrats Proposed Tax Increases Are A Recipe For Disaster Washington Times

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

President Biden S Capital Gains Tax Plan Forbes Advisor

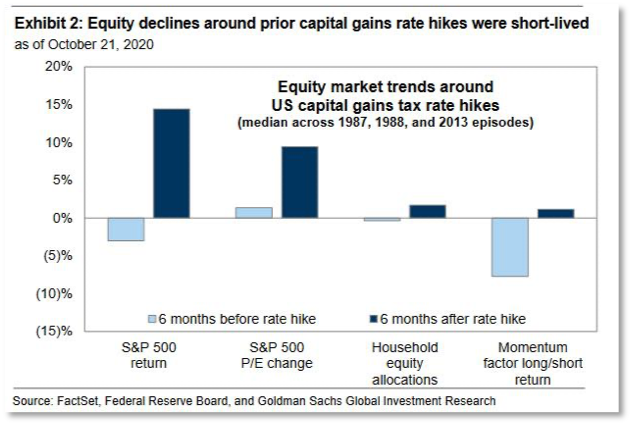

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Effects Of Changing Tax Policy On Commercial Real Estate

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

What You Need To Know About Capital Gains Tax

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Tax Archives Tek2day